Moreover, the lucky validator who will get picked earns not merely the typical benefits and also the transaction service fees and any further worth they are able to squeeze out with the block (termed MEV). It's like winning a prize by using a reward on prime!

Withdrawing your copyright prior to finishing the lock-up interval usually results in forfeiting any earned benefits for the duration of that time, according to the platform's guidelines.

Source: Ethereum.org Our final solution will garner you the very best returns for staking, but In addition it offers essentially the most challenges: working your own validator.

Benefits might also decrease as additional ETH is staked as the pool of rewards is distributed among additional participants, so timing and current market developments can influence your returns.

Any time you engage in pooled staking, your ETH is coupled with contributions from other contributors into an individual pool. This pooled Ether powers validator nodes about the Ethereum community.

Pooled staking is really a collaborative method of Ethereum staking, where by multiple people today Mix their ETH to variety a staking pool. This technique lets end users with smaller sized amounts of ETH to engage in the network's security and get paid rewards.

Aaron is quoted by several established retailers, and is particularly a printed author himself. Even all through his free time, he enjoys exploring the market tendencies, and in search of another supernova.

One of many pleasing aspects of operating a node through platforms like Rocket Pool is definitely the potential for larger yearly percentage prices (APR).

In Explore The Potential Earnings From Ethereum Staking contrast, a PoS program relies on validators who will be chosen to build new blocks dependant on the number of cash they hold and therefore are prepared to "stake" or lock up in a smart contract.

Economical Motivation: To operate a validator on Ethereum, you'll want to stake at least 32 ETH, which is a major expenditure. This total is locked in the network, and any issues or technical issues could end in penalties, such as the loss of some or your entire staked ETH.

Each and every staking method comes along with its personal benefits, rendering it easier to discover an alternative that aligns together with your financial investment objectives and experience. Validator nodes deliver full Handle, staking pools offer accessibility, and liquid staking provides overall flexibility for DeFi end users.

A little amount of staking swimming pools could turn out managing a large part of the staked ETH, which fits against the decentralized principles of Ethereum. This centralization could create vulnerabilities, like the potential of censorship or network manipulation.

Passive Money Potential: Staking provides a means to gain rewards with no need to market your Ethereum. By staking, you can get paid a gradual stream of passive revenue that compounds as time passes, growing your ETH holdings.

As an example, if you have a large amount of ETH as well as complex expertise to handle your individual stake, then solo staking may very well be the most suitable choice in your case. In the meantime, for those searching for ease, staking on the centralized exchange may be the best technique.

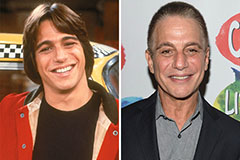

Tony Danza Then & Now!

Tony Danza Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!